A correction invoice is a specific accounting document. It is issued by the seller in strictly defined situations, such as, for example, reducing or increasing the tax base or returning goods or granting a discount. Depending on the reason for issuing the correction, there are different ways of dealing with it.

The data that should be included in the corrective invoice are these are:

- sequential number and date of issue;

- data contained in the invoice to which the corrective invoice relates

- date of issue;

- buying and selling sides: seller and buyer,

- the invoice number

- name (type) of goods or services subject to correction;

Table of contents

Table of contentsGlossaryPOST - add invoice correction DELETE single invoice correctionPOST - Initialise file uploading for invoice correctionsPOST - Complete file uploading for invoice corrcetionGET single invoice corrections

Glossary

Name | Explanation |

correctionType | Type of correction ("VALUABLE" "QUANTITATIVE”) |

clientData:

clientId

tin

clientType

phone

invoiceEmail | Buyer's data:

Identifier number of buyer

Type of buyer ("INDIVIDUAL" "ORGANIZATION”)

|

clientData → addressData

city

country

name

postalCode

street | Address of buyer |

notes | invoice notes |

payerData:

clientId

tin

phone | payer data:

Identifier number of payer |

payerData→ addressData

city

country

name

postalCode

street | address of payer |

tenantData:

tin | seller details: |

tenantData → addressData

city

country

name

postalCode

street | address of seller |

operatorData

id

name | operator assigned to the customer (this information is not displayed on the invoice correction)

<uuid> for example - 00e9e304-e5df-450a-a861-0211c471096b |

number | invoice correction number |

customerPurchaseNumbers | the customer order number to which the invoice relates |

documentDate | date of creation of the document |

totalPrices:

netPrice

grossPrice

taxValue |

number

number

number |

paymentDate | payment deadline |

saleDate | sale date |

currencyCode | possible to choose: "AED" "AFN" "ALL" "AMD" "ANG" "AOA" "ARS" "AUD" "AWG" "AZN" "BAM" "BBD" "BDT" "BGN" "BHD" "BIF" "BMD" "BND" "BOB" "BOV" "BRL" "BSD" "BTN" "BWP" "BYR" "BZD" "CAD" "CDF" "CHF" "CLF" "CLP" "CNY" "COP" "CRC" "CUC" "CUP" "CVE" "CZK" "DJF" "DKK" "DOP" "DZD" "EGP" "ERN" "ETB" "EUR" "FJD" "FKP" "GBP" "GEL" "GHS" "GIP" "GMD" "GNF" "GTQ" "GYD" "HKD" "HNL" "HRK" "HTG" "HUF" "IDR" "ILS" "INR" "IQD" "IRR" "ISK" "JMD" "JOD" "JPY" "KES" "KGS" "KHR" "KMF" "KPW" "KRW" "KWD" "KYD" "KZT" "LAK" "LBP" "LKR" "LRD" "LSL" "LYD" "MAD" "MDL" "MGA" "MKD" "MMK" "MNT" "MOP" "MRO" "MUR" "MVR" "MWK" "MXN" "MXV" "MYR" "MZN" "NAD" "NGN" "NIO" "NOK" "NPR" "NZD" "OMR" "PAB" "PEN" "PGK" "PHP" "PKR" "PLN" "PYG" "QAR" "RON" "RSD" "RUB" "RWF" "SAR" "SBD" "SCR" "SDG" "SEK" "SGD" "SHP" "SLL" "SOS" "SRD" "SSP" "STD" "SYP" "SZL" "THB" "TJS" "TMT" "TND" "TOP" "TRY" "TTD" "TWD" "TZS" "UAH" "UGX" "USD" "USN" "USS" "UYU" "UZS" "VEF" "VND" "VUV" "WST" "XAF" "XAG" "XAU" "XBA" "XBB" "XBC" "XBD" "XCD" "XDR" "XFU" "XOF" "XPD" "XPF" "XPT" "XSU" "XTS" "XUA" "XXX" "YER" "ZAR" "ZMW” |

bankAccountNumber | Bank account number |

items:

lineNumber

splitPayment

type

itemName

gtin

sku

series

manufacturer

notes

pkwiu

discount

quantity

unit

orderReferenceNumber

orderReferenceLineNumber

goodsIssuedNoteNumber

goodsIssuedNoteLineNumber | information about the products on the invoice

format: <int32>

Polish mpp - mechanizm podzielonej płatności

possible to choose: "PRODUCT" or "SERVICE”

name of product

number

number

the order number to which the invoice relates

refers to the line number on the order, format: <int32>

the goods issued note number to which the invoice relates

refers to the line number on the goods issued note,format:<int32> |

items→ linePrices:

netPrice

grossPrice

taxValue | Information on payments for a particular product line on the invoice correction:

number

number

number |

items→ taxRate:

name

value | Tax information:

Ex. 5%, NP etc.

number, Tax rate in percentage value without symbol, ex. 5 instead of 5%. It could be also a floating point value |

items→ itemPrices:

netPrice

grossPrice

taxValue | Information about price for products

number

number

number |

items→ itemBasePrices:

netPrice

grossPrice

taxValue | Information about base price for products

|

items→ additionalCosts

type | Information about additional costs for products

type of additional costs |

additionalCosts → itemPrices:

netPrice

grossPrice

taxValue | Information about additional costs for products |

additionalCosts → linePrices:

netPrice

grossPrice

taxValue | information on additional costs for product lines |

paymentMethodData

id

name | payment method information

Identifier number of payment

name of information method |

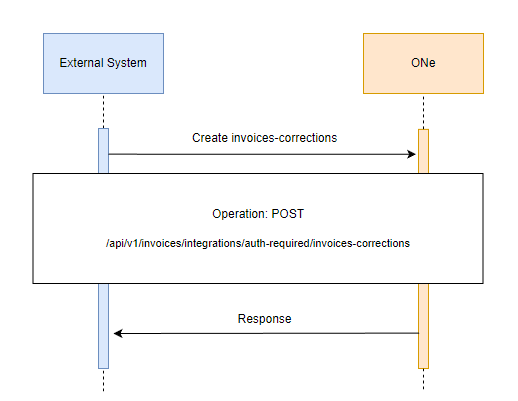

POST - add invoice correction

In order to add goods received note to ONe platform use POST

/api/v1/invoices/integrations/auth-required/invoice-corrections. The diagram below shows the dependency of communicating with the API:

Example request:

jsoncurl -X POST "https://api-preprod.one.unity.pl/api/v1/invoices/integrations/auth-required/invoice-corrections" -H "accept: */*" -H "one-tenant: {tenant}" -H "ApiAuth: {apiKey}" { "correctionType": "VALUABLE", --required "notes": [ "string" ], "clientData": { --required "clientId": "org:7fe1fd60-2da4-49c1-a22e-950c630457b6", --required "tin": "11111111", "clientType": "ORGANIZATION", --required "addressData": { --required "city": "Wroclaw", --required "country": "Poland", --required "name": "Warehouse", --required "postalCode": "55-555", --required "street": "Leska" --required }, "phone": "11111111", "invoiceEmail": "example@b2b.one" }, "payerData": { "clientId": "org:e8104641-f655-42c0-9ed0-176a4fe8e604", "addressData": { "city": "Wroclaw", "country": "Poland", "name": "Warehouse", "postalCode": "55-555", "street": "Leska" }, "tin": "11111111111", "phone": "11111111111" }, "tenantData": { --required "addressData": { --required "city": "wroclaw", --required "country": "Polska", --required "name": "ONe Company", --required "postalCode": "55-342", --required "street": "Miedzyleska" --required }, "tin": "11111111" --required }, "operatorData": { "id": "86b86ebc-ba2f-4f47-bd46-e25803d81a0d", "name": "Kacper Kacprowicz" }, "number": "111/korekta", --required "customerPurchaseNumbers": [ --required "100/d" ], "documentDate": "2022-12-12", --required "totalPrices": { --required "netPrice": -110, --required "grossPrice": -10, --required "taxValue": -40 --required }, "paymentDate": "2022-12-12", --required "saleDate": "2022-12-12", --required "currencyCode": "PLN", --required "bankAccountNumber": "21434235231234", "items": [ --required { "lineNumber": 1, --required "splitPayment": true, "type": "PRODUCT", --required "itemName": "Programowany, bezprzewodowy regulator temperatury", --required "gtin": "534634523522", "sku": "091FLRFV2", --required "series": "SALUS", "manufacturer": "SALUS LIMITED", "notes": [ --required "example note" ], "linePrices": { --required "netPrice": 550, --required "grossPrice": 30, --required "taxValue": 20 --required }, "pkwiu": "58.13.10.0", "taxRate": { --required "name": "Tax", --required "value": 0.23 --required }, "itemPrices": { --required "netPrice": 990, --required "grossPrice": 90, --required "taxValue": 50 --required }, "discount": 10, --required "itemBasePrices": { "netPrice": 5, "grossPrice": 15, "taxValue": 5 }, "additionalCosts": [ --required { "type": "KGO", --required "itemPrices": { --required "netPrice": 8, --required "grossPrice": 9, --required "taxValue": 1 --required }, "linePrices": { --required "netPrice": 40, --required "grossPrice": 80, --required "taxValue": 0.23 --required } } ], "quantity": 5, --required "unit": "szt.", --required "orderReferenceNumber": "100/d", "orderReferenceLineNumber": 1, "goodsIssuedNoteNumber": "71/06/2022", "goodsIssuedNoteLineNumber": 1, "invoiceReferenceLineNumber": 1, --required "invoiceReferenceNumber": "FV/699/03/2022" --required } ], "paymentMethodData": { --required "id": "497f6eca-6276-4993-bfeb-53cbbbba6f08", --required "name": "example payment name" --required } }

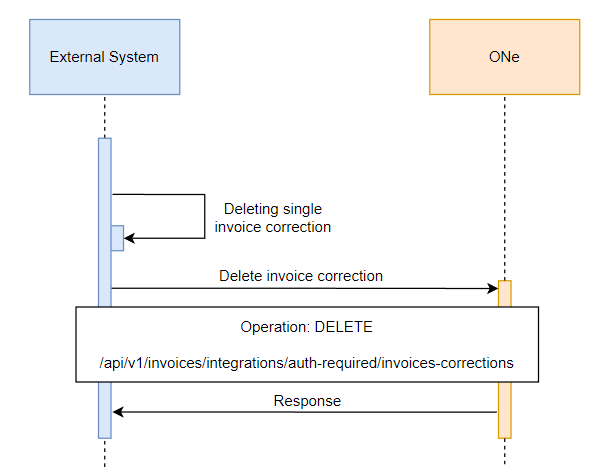

DELETE single invoice correction

Use Delete

/api/v1/invoices/integrations/auth-required/invoice-corrections to delete existing single invoice corrections.The sequence diagram below shows the dependency of communicating with the API:

Use the parameter below to delete invoice correction:

number

Example request:

jsoncurl -X DELETE DELETE "https://api-preprod.one.unity.pl/api/v1/invoices/integrations/auth-required/invoice-corrections?number=9999%2F06%2F2022" -H "accept: */*" -H "one-tenant: {tenant}" -H "ApiAuth: {apiKey}"

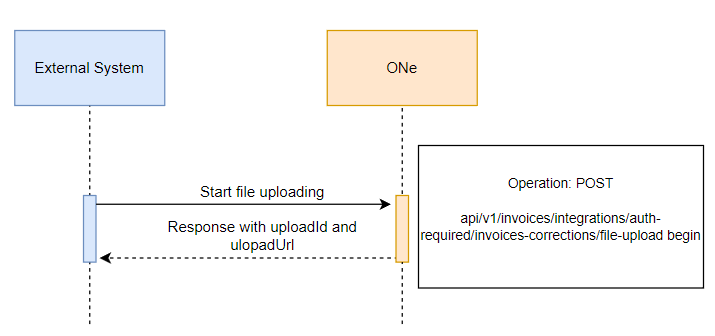

POST - Initialise file uploading for invoice corrections

On the ONe platform, it is possible to send a document in the form of a PDF file to a specific goods issued notes. Use POST

api/v1/invoices/integrations/auth-required/invoices-corrections/file-upload begin to receive parameters on the basis of which it will be possible to add a document to our server.To add the document to our server, use an external tool. For example Talend Api Tester. At the end of the description, we will show an example of this tool how to add a file to our server.

The sequence diagram below shows the dependency of communicating with the API:

Use the parameter to initialise file uploading for a specific document:

fileExtension

goodsReceivedNoteNumber

Example request:

jsoncurl -X POST "https://api-preprod.one.unity.pl/api/v1/invoices/integrations/auth-required/invoice-correction/file-upload-begin?fileExtension=pdf&number=9999%2F06%2F2022" -H "accept: */*" -H "one-tenant: {tenant}" -H "ApiAuth: {apiKey}"

In response you will receive information needed to add documents to our server

uploadUrl

uploadId

Example response:

json{ "uploadUrl": "https://{link}", "uploadId": "a36b3639-4ec6-438b-a377-7b718e733105" }

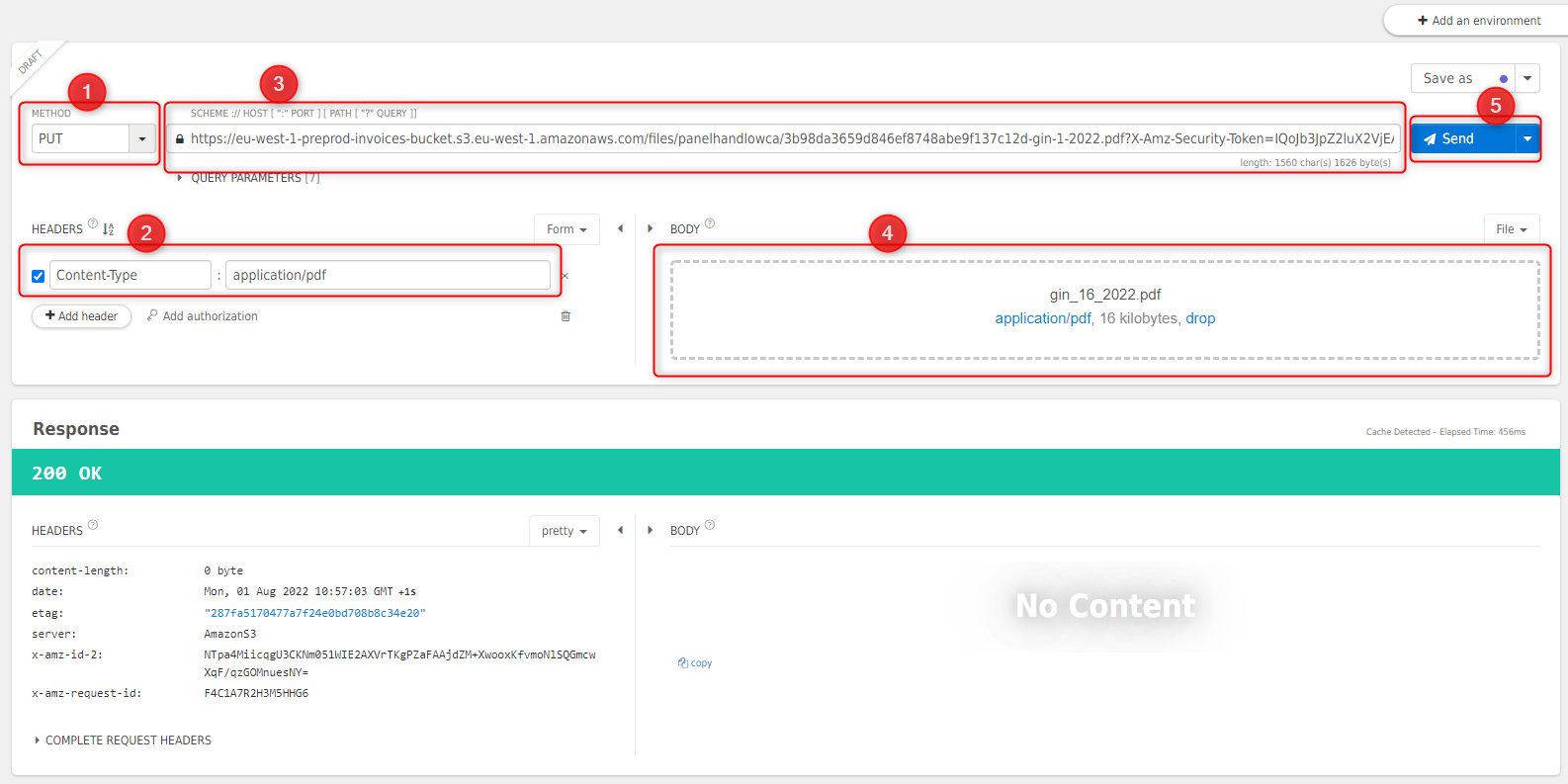

When we get

uploadUrland uploadId we can use tool to add documents to our server. Below we present how to do it using an Talend API Tester.

1 - method - PUT

2 - in headers - content-Type and choose application/pdf

3 - paste the link received in resonse to the request

4 - add file

5- press send

The document has been added to the server.

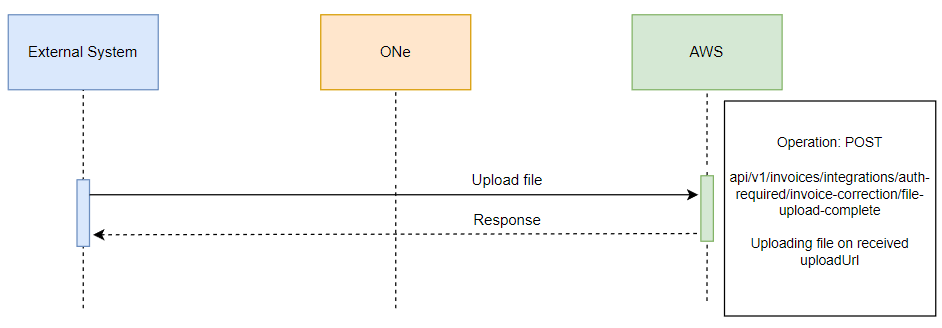

POST - Complete file uploading for invoice corrcetion

This endpoint is used to complete the process of adding a document to our server. Use this endpoint after physically adding documents to the server - POST

/api/v1/invoices/integrations/auth-required/invoice-corrections/file-upload-complete.The diagram below shows the dependency of communicating with the API:

Use the parameter below in query to find a specific goods received note:

uploadId

uploadId it is possible to get from this endpoint (POST - Initialise file uploading for goods received note)Example request:

jsoncurl -X POST "https://api-preprod.one.unity.pl/api/v1/invoices/integrations/auth-required/invoice-corrections/file-upload-complete?uploadId=fbe457b2-c090-436e-8e80-3473e4404819" -H "accept: */*" -H "one-tenant: {tenant}" -H "ApiAuth: {apiKey}"

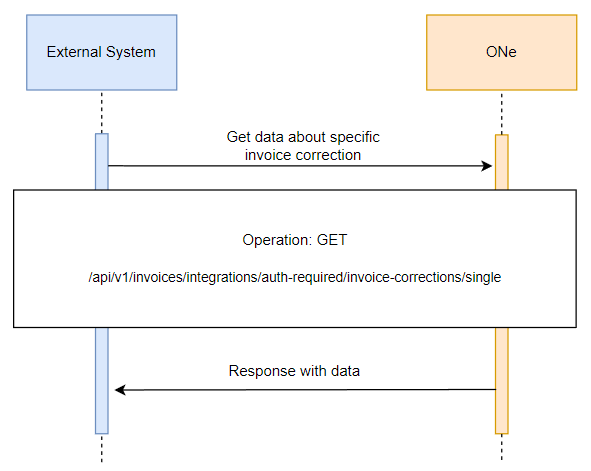

GET single invoice corrections

There is possible to get specific invoice correction. Use GET

/api/v1/invoices/integrations/auth-required/invoice-corrections/single using specific ID. The diagram below shows the dependence of communicating with the API:

Use the parameter in query below to get information about specific invoice correctionhttps://api-preprod.one.unity.pl/api/v1/invoices/integrations/auth-required/invoices/single?number=9999%2F06%2F2022":

number

Example request:

jsoncurl -X GET "https://api-preprod.one.unity.pl/api/v1/invoice-corrections/integrations/auth-required/invoices/single?number=9999%2F06%2F2022" -H "accept: */*" -H "one-tenant: {tenant}" -H "ApiAuth: {apiKey}"

In response you will receive information about specific invoice correction

Example response:

json{ "correctionType": "VALUABLE", "clientData": { "clientId": "org:7fe1fd60-2da4-49c1-a22e-950c630457b6", "clientType": "ORGANIZATION", "addressData": { "city": "Wroclaw", "country": "Poland", "name": "Warehouse", "postalCode": "55-555", "street": "Leska" }, "tin": "11111111", "phone": "11111111", "invoiceEmail": "example@b2b.one" }, "payerData": { "clientId": "org:e8104641-f655-42c0-9ed0-176a4fe8e604", "addressData": { "city": "Wroclaw", "country": "Poland", "name": "Warehouse", "postalCode": "55-555", "street": "Leska" }, "tin": "11111111111", "phone": "11111111111" }, "tenantData": { "addressData": { "city": "wroclaw", "country": "Polska", "name": "ONe Company", "postalCode": "55-342", "street": "Miedzyleska" }, "tin": "11111111" }, "operatorData": { "id": "86b86ebc-ba2f-4f47-bd46-e25803d81a0d", "name": "Kacper Kacprowicz" }, "fileData": null, "number": "111/korekta", "customerPurchaseNumbers": [ "100/d" ], "documentDate": "2022-12-12", "totalPrices": { "netPrice": -110, "grossPrice": -10, "taxValue": -40 }, "paymentDate": "2022-12-12", "saleDate": "2022-12-12", "currencyCode": "PLN", "bankAccountNumber": "21434235231234", "notes": [ "string" ], "items": [ { "lineNumber": 1, "type": "PRODUCT", "itemName": "Programowany, bezprzewodowy regulator temperatury", "gtin": "534634523522", "sku": "091FLRFV2", "series": "SALUS", "manufacturer": "SALUS LIMITED", "notes": [ "example note" ], "linePrices": { "netPrice": 550, "grossPrice": 30, "taxValue": 20 }, "pkwiu": "58.13.10.0", "taxRate": { "value": 0.23, "name": "Tax" }, "itemPrices": { "netPrice": 990, "grossPrice": 90, "taxValue": 50 }, "discount": 10, "itemBasePrices": null, "additionalCosts": [ { "type": "KGO", "itemPrices": { "netPrice": 8, "grossPrice": 9, "taxValue": 1 }, "linePrices": { "netPrice": 40, "grossPrice": 80, "taxValue": 0.23 } } ], "quantity": 5, "unit": "szt.", "orderReferenceNumber": "100/d", "orderReferenceLineNumber": 1, "goodsReceivedNoteNumber": null, "goodsReceivedNoteLineNumber": null, "invoiceReferenceLineNumber": 1, "invoiceReferenceNumber": "007/06/2022" } ], "paymentMethodData": { "id": "497f6eca-6276-4993-bfeb-53cbbbba6f08", "name": "example payment name" }, "invoiceReferenceNumbers": [ "007/06/2022" ], "orderReferenceNumbers": [ "100/d" ], "goodsIssuedNoteReferenceNumbers": [], "goodsReceivedNoteReferenceNumbers": [] }